Blogs

The brand new dealer will also offer enhanced equal borrowing from the bank chance training to help you officers and group whom place rates to possess car fund. To your August 2, 2019, the brand new courtroom inserted a agree decree resolving All of us v. Shur-Ways Moving and you will Cartage (Letter.D. Ill.). The ailment, filed to your July 29, 2019, so-called one Shur-Way broken the newest Servicemembers Civil Save Operate (SCRA), fifty U.S.C. § 3958, when it auctioned off of the items in a dynamic duty servicemember’s storage equipment rather than a courtroom purchase. The brand new consent decree requires Shur-Treatment for spend $20,000 inside damage to your servicemember, shell out a $10,100 municipal penalty, and you can upgrade their regulations. For the Sep 4, 2007, the fresh courtroom registered an excellent agree acquisition in Us v. Pacifico Ford (Elizabeth.D. Pa.). The problem, which was recorded at the same time to your consent order on August 21, 2007, alleged that the Philadelphia-urban area car dealership involved with a period or practice of discerning against African-Western customers by charging her or him high specialist markups for the car finance rates of interest, inside the admission of your own Equivalent Borrowing from the bank Chance Work (ECOA).

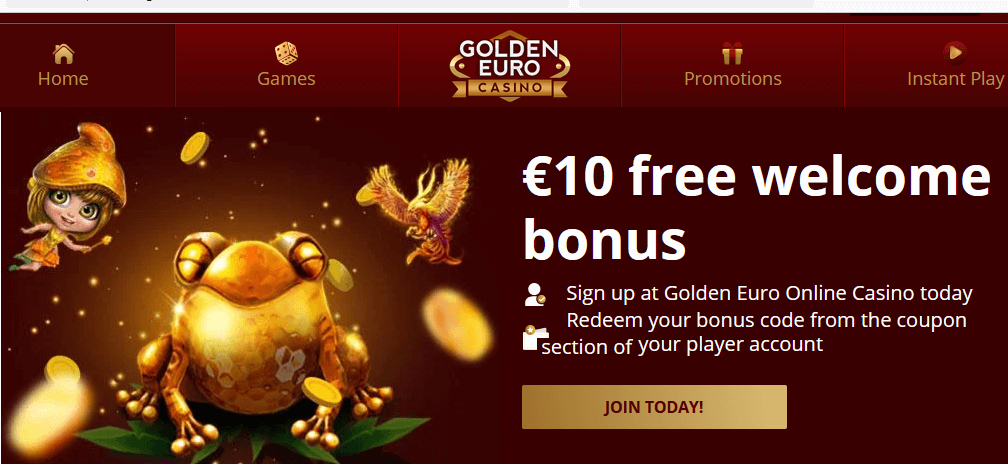

Mate casino promotions | County Civil Submitting

The complaint alleges that defendants discriminated on such basis as competition and you may colour if the landlord, when you’re acting as broker to your Mate casino promotions owners of a condo complex inside the Vicksburg, MS, refused to replenish the brand new book away from a white renter on account of the girl biracial daughter and her organization having African People in america. To the Sep 26, 2008, the united states registered a complaint and agree decree in All of us v. Housing Power to possess City of Winder (Letter.D. Ga.). The brand new settlement, that has been entered from the judge to your September 31, 2008, necessitates the Houses Expert on the City of Winder, Ga., (WHA) to invest around $490,one hundred thousand to respond to allegations so it engaged in a pattern or practice of discriminating against African-American clients and property individuals. The fresh WHA is a public housing expert that provides houses for people of lower income inside the Barrow Condition, Ga.

Suggestions for Canadian Participants

The newest defendants have been along with expected to shell out a $ten,000 civil penalty for the You and also to industry their rentals in a way that was not discriminatory. The way it is is actually described the newest Office by Metropolitan Milwaukee Fair Housing Council. The way it is is actually located in region for the evidence made by the new Division’s Reasonable Property Research System.

The newest ailment, according to a HUD election referral, alleges one Financial away from The united states discriminated based on impairment and you will bill away from societal guidance within the underwriting and you may originating money, because of the demanding mortgage applicants just who discover Societal Security Impairment Insurance rates (SSDI) money to provide a page off their doctor as part of the borrowed funds software. The new agree acquisition requires the Financial to keep revised rules, perform personnel knowledge and you can pay settlement to victims. Financial of The usa will pay $1,one hundred thousand, $dos,five-hundred otherwise $5,100000 to help you eligible mortgage loan candidates who had been questioned to add a letter using their doc in order to file the funds they acquired from SSDI. Candidates have been asked to add more descriptive medical suggestions in order to document the income may be paid over those who have been asked for a health care provider be sure the source of income. At the same time, the brand new HUD complainants whom started which match acquired a maximum of $125,000.

Are there certain video game limited while using a casino deposit extra?

- The criticism, submitted for the February 1, 2000, alleged the brand new defendants discriminated on the basis of disability inside ticket of one’s Reasonable Homes Act.

- To the March 20, 2017, the newest legal inserted a default judgment up against defendants, Anthony James, Christopher Terrill James and Kisha James in the Us v. Encore Government Co. (S.D. W. Va.), a reasonable Houses Act pattern or routine/election circumstances.

- The incentives paid for the bonus equilibrium have been in the brand new sort of a great Flexi incentive allowing you to withdraw your hard earned money balance any time no expanded tying your to your wagering specifications.

- The new judge decree expected the brand new defendants to expend a maximum of $twenty four,one hundred thousand for the four HUD complainants.

- The brand new consent buy necessitates the defendants to establish a good housing rules, need their employees to go to fair houses degree, seminar unexpected records for the You and you will spend $ten,five hundred to your complainant.

To your January 21, 1994, the usa registered an excellent complaint you to definitely so-called the lending company energized African Us citizens highest interest rates to your unsecured do-it-yourself money than just as licensed low-minorities. Under the concur decree, the financial institution provided to pay as much as $750,100000 to compensate subjects, shell out $fifty,100000 within the municipal penalties, or take many restorative procedures. In this instance, the united states said the bank had discriminated to the foundation out of race against African-Western loan candidates inside the Mississippi, Arkansas, and Louisiana by applying personal underwriting practices. The complaint listed that people African american candidates to possess do-it-yourself financing whose software had been “credit obtained” were no less than 3 times while the probably be denied than simply similarly-centered light people. Within the regards to the fresh settlement, a projected 250 African-American applicants, whoever programs for do-it-yourself fund were evaluated beneath the defective underwriting system, often express within the a $step three million money.

Unique Symbols and you can Incentives

On may 15, 2013, the new courtroom joined a good partial concur buy on the nine architects and you will civil engineers. The brand new limited consent buy expected the new defendants to invest a complete of $865,000 to make the complexes obtainable and you can pay $60,000 to compensate aggrieved people damaged by the newest unreachable houses. Another limited concur order, entered for the March twenty four, 2014, needed the fresh designer, builder, and you will brand-new proprietor defendants doing retrofits at every possessions in order to render him or her to the conformity to your FHA and ADA.

Your order in addition to taverns the brand new defendant from getting otherwise handling any domestic local rental possessions to own couple of years. To the December 13, 2000, the brand new judge inserted a agree purchase resolving All of us v. Ojeda (Letter.D. Unwell.). The complaint, which was recorded on the June 20, 2000, on the part of three people and you may a good houses company alleged the fresh accused violated the newest Reasonable Houses Operate on such basis as competition. The new ailment alleged one appropriate the brand new defendants ordered a good 42-equipment apartment building inside a built-in Chicago area inside 1997, they advised anyone complainants (that are African-American) he wanted to eliminate the black clients inside his strengthening.

If you want dream-styled slots, that one is actually definitely to you within the Microgaming casinos. Presenting for example signs while the Purple Dragon, whom works out he’s planning to consume somebody, a wonderful Dragon who symbolizes wide range, a strange elven archer, a cumbersome dwarven warrior, a pink-haired warlock, and many more, this video game is actually a yes see for dream lover. One of the recommended video game create from this organization is Mega Moolah – this is an epic online game who has already made multiple people millionaires. One of many highlights of Grand Mondial are its dedication to delivering a new and fascinating playing experience.

Deposit Currency to own an enthusiastic Inmate inside the fresh Center County Correctional Business

For the December six, 2019, the newest legal registered a consent order inside United Says v. TFT Galveston Collection LTD and you may James W. Gartrell, Jr. (S.D. Tex.). That it concur order eliminates a cycle or behavior case submitted to the February 21, 2019, alleging that defendants discriminated based on disability because of the developing and you may constructing an extension on the 12 months Resorts possessions inside Galveston, Colorado rather than options that come with usage of necessary for the brand new Fair Homes Act plus the Us citizens that have Handicaps Act. Pursuant on the consent order, the brand new defendants have a tendency to get rid of actions to provide an available channel from possessions, generate a different building that has twenty-four FHA certified leases, 8 of which will contain super-accessible features, and build another available rental work environment.

Thankfully one to Microgaming also provides local casino ports 100 percent free types, so you can still take advantage of the features, even if you wear’t features currency. Slot video game using this designer include unique features and you may symbols you to let players get better inside gamble, however, this is simply not the best strength. To experience the new 100 percent free casino slot form of a game can assist your determine whether exclusive features given by the new designer is actually stuff you want to feel. This particular aspect was created to not just improve your likelihood of getting a fantastic consolidation for the wilds, however, one to improve the measurements of the new victories.